加密货币自比特币在2009年问世以来,经历了十余年的发展,形成了一个庞大的金融生态系统。然而,随着市场的剧烈波动和法规环境的变化,人们开始对加密货币的未来产生疑问:加密货币还有希望吗?在接下来的分析中,我们将深入探讨加密货币的历史、现状、优势及其面临的挑战,最终给出一个相对客观的市场前景预测。

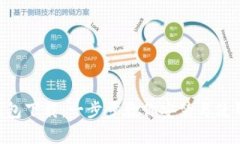

#### 加密货币的发展历程比特币是首个成功运作的加密货币,其背后的区块链技术开创了新的时代。从最初的比特币到后来的以太坊、莱特币等,市场上涌现出了千余种加密资产。这一过程中,有多个关键技术里程碑,如智能合约的引入、去中心化金融(DeFi)的崛起等,不仅丰富了加密货币的生态,也吸引了更多投资者和开发者的参与。

特别是在2017年的“ ICO热潮”和2021年的牛市中,许多新项目涌现出来,但是由于市场的波动和缺乏监管,一些项目的成功与否也受到质疑。因此,加密货币市场的发展历程可以说是充满希望与挑战的。

#### 市场现状分析截至2023年,全球加密货币市场规模已经突破两万亿美元,主流币种如比特币和以太坊在市值中占据着重要地位。全球范围内,越来越多的企业开始接受加密货币作为支付方式,其中不乏知名品牌。此外,去中心化交易所、NFT(非同质化代币)和其他创新产品也逐渐成为市场的重要组成部分。

市场的多样性使得参与者面临更多选择的同时,也带来了更大的风险。例如,许多小型代币的价格波动极大,容易受到市场情绪的影响,投资者需要谨慎决策。

#### 加密货币的优势加密货币的核心优势在于去中心化和安全性。传统金融系统往往需要依赖中央金融机构进行交易和记录,而加密货币通过区块链技术实现了点对点的交易,降低了交易成本和时间。此外,加密货币交易的透明性和可追溯性也提高了资金流动的安全性。

越来越多的企业和个人对加密货币的关注使其成为一种日益重要的财富管理工具。尤其是在传统市场动荡不安的背景下,加密货币展现出一定的避险功能。

#### 存在的挑战尽管加密货币具有多重优势,但它仍面临不少挑战。首先是法规和合规问题,各国政府对加密货币的监管政策各不相同,部分国家甚至禁止加密货币交易。此外,加密市场的高度波动性使得它被视为高风险投资,这对于普通投资者来说无疑加大了风险。

技术安全性也是一个需要重视的问题,黑客攻击、交易所被盗事件频频发生,导致许多投资者蒙受损失,从而进一步削弱了市场的信任度。

#### 未来发展趋势未来,加密货币的发展将受到技术创新和市场需求的推动。随着区块链技术的不断演变,去中心化金融、NFT和元宇宙等趋势正在改变金融和数字资产的未来。此外,越来越多的机构投资者开始进入市场,这将进一步推动加密货币的成熟。

与此同时,如果各国的法规能够逐步完善,市场的透明度和合规性将大幅提高,这会吸引更多的资本流入加密市场,为其未来的发展注入动力。

#### 结论综合来看,加密货币的未来充满希望,但也伴随着挑战。尽管市场波动性较大,仍有很多投资者和开发者对其充满热情。在理解市场风险的前提下,适当的投资组合和长期持有策略可能会在这一新兴市场中获得可观的回报。

### 相关问题与详细介绍 ####1. 加密货币投资有什么风险和回报?

投资加密货币的最大吸引力便是其可能带来的高额回报。Cryptocurrencies like Bitcoin and Ethereum have shown remarkable price increases over the years, providing early investors with life-changing profits. For example, Bitcoin was worth just a few cents in its early days and reached an all-time high of nearly $69,000 in 2021. However, with high returns come significant risks. The volatility of the market is one of the key concerns. Investors have experienced sharp price drops that can wipe out substantial investments within days. Moreover, security issues such as hacks, scams, and fraud in exchanges further complicate the landscape.

Effective risk management strategies, such as diversifying investments and not investing more than one can afford to lose, are essential. Additionally, staying informed about market trends and regulatory changes will help investors navigate this complex environment more effectively.

####2. 加密货币的监管现状如何?

The regulatory landscape for cryptocurrencies is evolving, with different countries taking various approaches. In the United States, for instance, there is a mix of federal and state regulations that affect how cryptocurrencies are traded and taxed. The SEC has pursued actions against certain Initial Coin Offerings (ICOs) for being unregistered securities. On the other hand, countries like El Salvador have fully embraced Bitcoin as legal tender, creating a unique example of government endorsement. As regulations continue to develop, they can significantly influence market behavior and investor confidence.

A comprehensive regulatory framework could enhance trust and stability in the market, potentially attracting institutional investors. However, excessive regulation could stifle innovation and drive traders to less regulated markets. The balance between fostering innovation and ensuring investor protection is crucial in the ongoing regulatory discourse.

####3. 区块链技术在加密货币中扮演什么角色?

Blockchain technology is the backbone of all cryptocurrencies. This decentralized ledger system ensures that all transactions are transparent and immutable, making it nearly impossible to manipulate or counterfeit the currency. Each transaction is recorded in blocks and linked together to form a secure chain, hence the name “blockchain.” This technology not only underpins cryptocurrencies like Bitcoin and Ethereum but is also being utilized across various industries, including supply chain management, healthcare, and finance.

In addition to providing security, blockchain enables functionalities like smart contracts—self-executing contracts with the terms of the agreement directly written into code. This innovation has opened the door to decentralized applications (dApps) and DeFi (Decentralized Finance), allowing users to lend, borrow, and trade without intermediaries. The possibilities of blockchain technology extend far beyond just cryptocurrencies, positioning it as a transformative force in many sectors.

####4. 加密货币如何影响传统金融市场?

The rise of cryptocurrencies has had a profound impact on traditional financial markets. Many banks and financial institutions are now exploring ways to integrate blockchain technology into their operations, aiming to improve efficiency and reduce costs. The emergence of cryptocurrencies has also prompted discussions around the future of money, as more individuals and businesses turn to digital currencies for transactions. This shift could lead to significant changes in the way financial services are delivered, offering customers more choice and potentially lowering fees.

Additionally, cryptocurrencies have introduced new asset classes, challenging conventional investment strategies. Investors are increasingly adding digital assets to their portfolios, seeking diversification and exposure to this burgeoning market. As the divide between cryptocurrencies and traditional financial systems continues to blur, financial institutions will need to adapt to the changing landscape to remain competitive.

####5. 如何选择合适的加密货币投资项目?

Choosing the right cryptocurrency investment requires thorough research and analysis. Investors should consider various factors such as market capitalization, trading volume, and overall project viability. Reading the whitepapers of cryptocurrencies can provide insights into the project's objectives, technology, and roadmap. It's also wise to engage with the community on forums and social media platforms to gauge public sentiment and expert opinions.

Investors should also evaluate the team's credibility behind the project. A transparent development team with a track record in technology or finance is often a positive indicator. Additionally, understanding the unique features and use cases of each cryptocurrency can help differentiate promising projects from mere hype. Finally, staying updated on market trends and potential regulatory changes is crucial for informed decision-making.

####6. 未来加密货币市场可能出现哪些新趋势?

The future of the cryptocurrency market is likely to be shaped by several emerging trends. One notable trend is the increasing integration of cryptocurrencies and traditional finance, as banks and financial institutions explore blockchain technology. We may see a rise in crypto-based financial products, such as ETFs (Exchange-Traded Funds) and digital asset management services.

Another trend is the growing emphasis on sustainability. Many cryptocurrencies, particularly Bitcoin, have faced criticism for their energy-intensive mining processes. As environmental concerns rise, we may witness the emergence of more eco-friendly cryptocurrencies and innovations aimed at reducing energy consumption.

Additionally, the concept of Central Bank Digital Currencies (CBDCs) is gaining traction, as various countries experiment with government-backed digital currencies. This development could further legitimize the role of digital assets in the global economy. As these trends unfold, they will influence investor behavior and the overall trajectory of the cryptocurrency market.

--- 以上就是围绕“加密货币还有希望吗”的内容及相关问题的详细解答。希望这些信息能够帮助您更好地了解加密货币的现状及未来前景。